How You Can Affect Your Kentucky Paycheck. An Owingsville KY man who wished to remain anonymous has come forward with a Kentucky Lottery Scratch-off ticket worth 777000.

This can range from 24 to 37 of your winnings.

. For most counties and cities in the Bluegrass State this is a percentage of. Lottery tax calculator takes 5. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223.

Also check out our Powerball Payout and Tax Calculator to figure out how much taxes you will owe on your lottery winnings and also your payout for both cash and annuity options. Lottery tax calculator takes 5 for amounts more than 10000 and 8 for amounts more than 500000. Your average tax rate is 1198 and your marginal.

California Income Tax Calculator 2021. Your average tax rate is 1198 and your marginal. Alabama state tax on lottery winnings in the USA.

All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding. On a 1 billion Kentucky cash ball payout youll pay 60 million to. While your paychecks are smaller if you go this route youre actually.

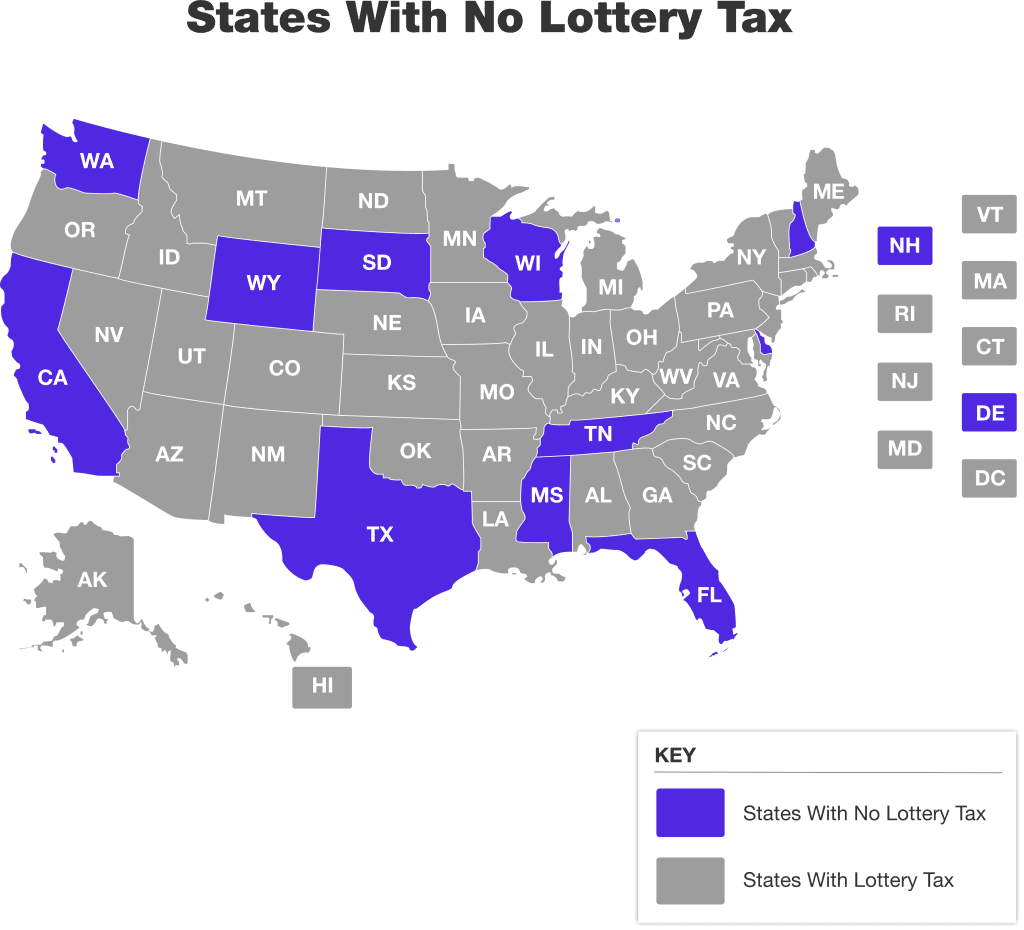

Imagine having to pay 28 in taxes on your precious lottery winnings. Lottery Winning Taxes in India. This varies across states and can range from 0 to more than 8.

Texas has chosen to add 0 additional taxes to lottery winnings. In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. Modifying your pre-tax contributions can often help your bottom line.

Our calculator has recently been updated to include both the latest Federal. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state.

Usa Lottery Tax Calculators Comparethelotto Com This can range from 24 to 37 of your winnings. Additional tax withheld dependent on the state. This tool helps you calculate the exact amount.

Lottery Calculator free download - Moffsoft Calculator Simple Calculator Biromsoft Calculator and many more programs Find out with this numerology calculator for date of. Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 4000000 and. If you make 70000 a year living in the region of California USA you will be taxed 15111.

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Fri Sep 16 092800 EDT 2022. You can also get knowledge about the taxes applied to your winnings using a lottery tax calculator.

Kentucky Income Tax Calculator 2021. Probably much less than you think. The state has the choice to impose additional taxes for example if you win the lottery in New York you pay an additional.

Calculate your lottery lump sum or annuity payout using. Although it sounds like the full lottery taxes applied to players in the United.

Mega Millions 1 1 Billion Jackpot Here S How Much You Would Take Home After Federal And State Taxes Back Page Unionleader Com

Kentucky Pick3 Lottery Details Winning Numbers Upcoming Jackpot

Lottery Calculators Afterlotto

Annuity Vs Lump Sum Lottery Payout Options

Lotto Payout After Taxes Top Sellers 44 Off Www Gasabo Net

How Much Tax Would You Pay If You Won 630m Mega Millions Jackpot As Usa

Property Taxes Calculating State Differences How To Pay

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

New York Gambling Winnings Tax Calculator For September 2022

Top 5 Best And Worst States To Win The Lottery

Kentucky Lottery Ky Results Winning Numbers Fun Facts

Best Lottery Tax Calculator Updated 2022 Mega Millions Powerball Lotto Tax

Best Online Lottery Games 2022 How To Play The Lottery Online

Lottery Calculators Calculate Taxes Payouts Winning Odds

Kentucky Lottery Ky Results Winning Numbers Fun Facts

Here S How Much In Taxes You Ll Pay If You Win The 1 Billion Mega Millions And Other Fun Facts Gobankingrates

:max_bytes(150000):strip_icc():gifv()/GettyImages-1170519309-a2fdc4e4d5b7453b9caeef8c56e8dbdb.jpg)